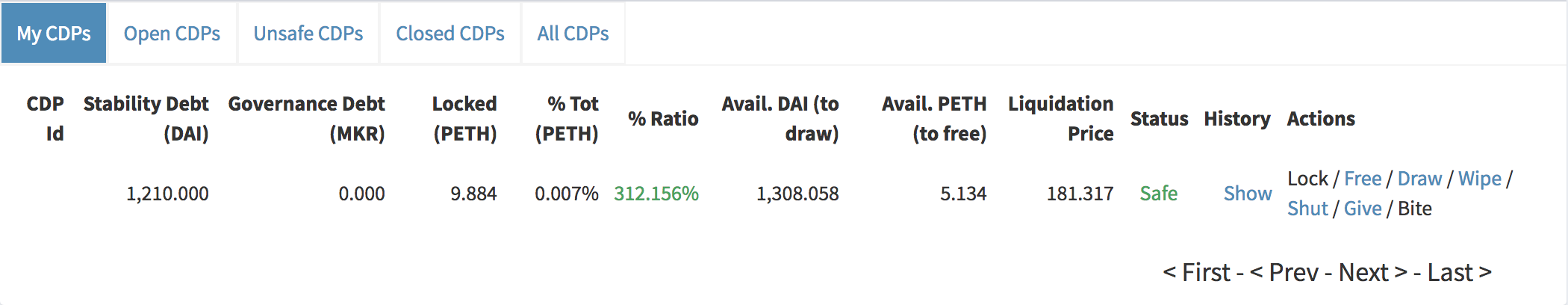

What is Collateralized Debt Position or CDP?

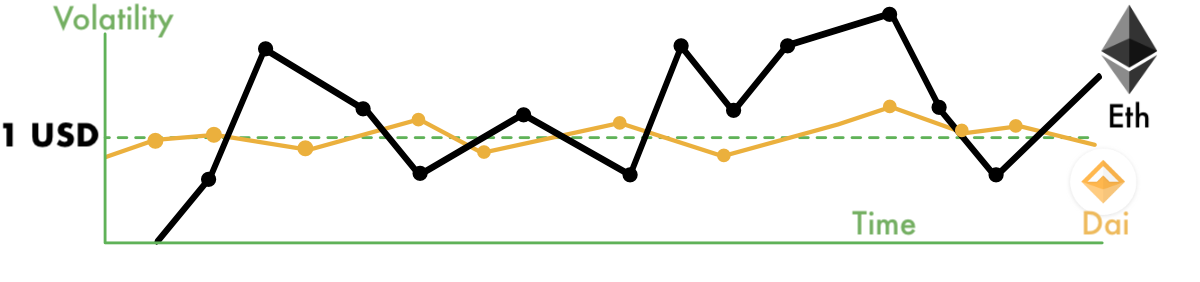

Collateralized Debt Position (CDP) is a financial-cryptocurrency concept, which has been developed since 2014 with the whole eco-system of Maker DAO project. Basically, the main purpose of Maker DAO is to minimize the price volatility on cryptocurrency markers through own Maker DAO stable coin (Dai) against the fiat currency. Thanks to this progress, it is now possible to create new functionalities like in traditional financial world but with the difference that everything is decentralized by blockchain technology and smart contracts.