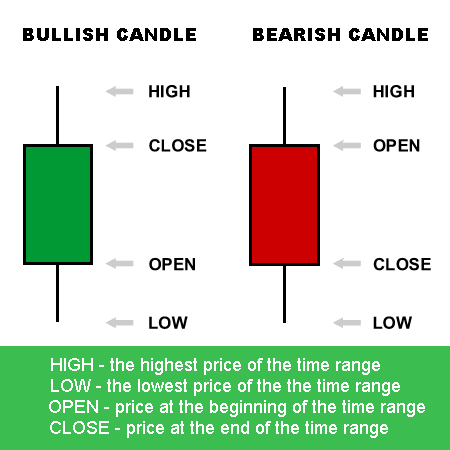

Basic navigation in Charts

Every trader must have excellent knowledge of orientation in Charts. Maybe you think the graph gives you information just about the actual price, but there is much more information than you think. If you want to be the successful trader, you have work with all available information. First of all, you have to know that we have 3 main types of charts.